Loan Against GPA Notary Property

Access Funds with Ease

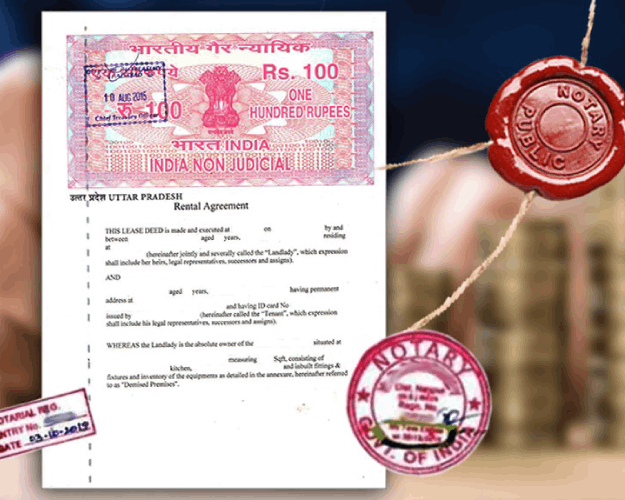

If you own a property registered under a General Power of Attorney (GPA) and Notarized, you can leverage its value to meet your financial needs with JMK Finance’s Loan Against GPA Notary Property service. This unique offering provides you with the opportunity to secure a loan against your GPA-notarized property, giving you the flexibility to manage your financial goals without having to sell your asset.

Why Opt for a Loan Against GPA Notary Property?

- Utilize Your Property’s Value: Unlock the potential of your GPA-notarized property by using it as collateral to secure a loan.

- Flexible Fund Usage: Whether it’s for business expansion, personal expenses, or investments, use the loan amount as per your needs.

- Competitive Interest Rates: Benefit from attractive interest rates tailored to your financial profile, helping you manage your repayments comfortably.

- Retain Property Ownership: Continue to enjoy the ownership and benefits of your property while accessing the funds you need.

- Customized Repayment Plans: Choose from a variety of repayment options that align with your financial situation, making it easier to manage your loan.

How to Apply for a Loan Against GPA Notary Property

Getting a loan against your GPA-notarized property with JMK Finance is simple and straightforward. Follow these steps to begin:

Reach out to us for an initial assessment of your GPA-notarized property. Our experts will evaluate its market value to determine your loan eligibility.

Gather and submit the necessary documents:

Identity Proof: PAN Card, Aadhaar Card, or Voter ID.

Address Proof: Utility Bills (Electricity, Gas, or Water).

Property Documents: Notarized GPA, original sale agreement, property tax receipts, and any other relevant documents.

Financial Documents: Income proof, bank statements, and any other documents as required.

Submit your application along with the required documents. Our team will handle the rest, processing your application efficiently to ensure a quick turnaround.

Once approved, the loan amount will be disbursed to your account, giving you immediate access to the funds.

We continue to support you throughout the loan tenure, ensuring that you have all the assistance you need to manage your repayments and any other queries.

FAQ

A GPA (General Power of Attorney) Notary Property refers to a property where the ownership or transaction rights are transferred through a General Power of Attorney document, which is then notarized. This allows the holder to act on behalf of the property owner.

Yes, JMK Finance offers loans against GPA Notary Properties. We assess the value of your property and provide a loan based on its market worth, giving you access to funds while retaining ownership of your property.

The loan amount is determined based on the market value of your GPA Notary Property, your financial profile, and the documentation provided. Our experts will conduct a thorough assessment to ensure you receive a fair and competitive loan offer.

Interest rates for loans against GPA Notary Properties vary based on factors such as loan amount, tenure, and your financial profile. JMK Finance offers competitive rates tailored to your specific needs.

The approval time can vary, but we strive to process your application as quickly as possible. Typically, once all documents are submitted and verified, the loan can be approved and disbursed within a few working days.

Yes, the funds obtained through a Loan Against GPA Notary Property can be used for various purposes, including business expansion, personal expenses, debt consolidation, or investment opportunities.